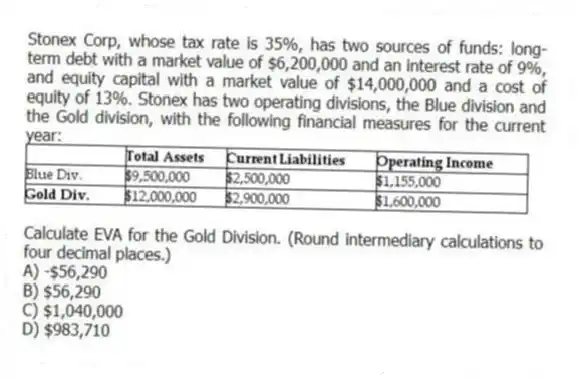

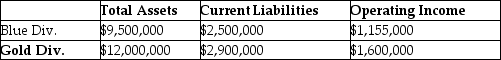

Stonex Corp, whose tax rate is 35%, has two sources of funds: long-term debt with a market value of $6,200,000 and an interest rate of 9%, and equity capital with a market value of $14,000,000 and a cost of equity of 13%. Stonex has two operating divisions, the Blue division and the Gold division, with the following financial measures for the current year:

Calculate EVA for the Gold Division. (Round intermediary calculations to four decimal places.)

A) -$56,290

B) $56,290

C) $1,040,000

D) $983,710

Correct Answer:

Verified

Q53: Care Inc., has two divisions that operate

Q54: Waldorf Company has two sources of funds:

Q55: Using residual income as a measure of

Q56: A company has operating income of $300,000,

Q57: Which of the following is the expression

Q59: Economic value added is equal to _.

A)

Q60: A major weakness of comparing two companies

Q61: Reducing the investment base to improve ROI

Q62: The objective of maximizing return on investment

Q63: Antique Corp uses the investment center concept

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents