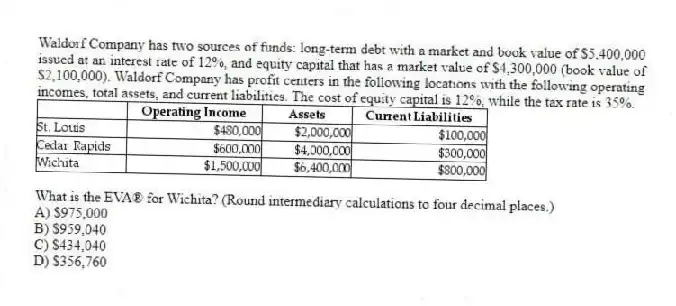

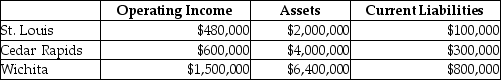

Waldorf Company has two sources of funds: long-term debt with a market and book value of $5,400,000 issued at an interest rate of 12%, and equity capital that has a market value of $4,300,000 (book value of $2,100,000) . Waldorf Company has profit centers in the following locations with the following operating incomes, total assets, and current liabilities. The cost of equity capital is 12%, while the tax rate is 35%.

What is the EVA® for Wichita? (Round intermediary calculations to four decimal places.)

A) $975,000

B) $959,040

C) $434,040

D) $356,760

Correct Answer:

Verified

Q40: Coldbrook Company has two sources of funds:

Q41: Springfield Corporation, whose tax rate is 34%,

Q42: Springfield Corporation, whose tax rate is 30%,

Q43: Care Inc., has two divisions that operate

Q44: Times Corporation, whose tax rate is 30%,

Q46: A company which favors the residual income

Q47: Coldbrook Company has two sources of funds:

Q48: Which of the following is the required

Q49: The required rate of return multiplied by

Q50: Waldorf Company has two sources of funds:

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents