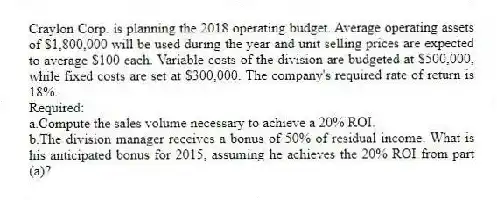

Craylon Corp. is planning the 2018 operating budget. Average operating assets of $1,800,000 will be used during the year and unit selling prices are expected to average $100 each. Variable costs of the division are budgeted at $500,000, while fixed costs are set at $300,000. The company's required rate of return is 18%.

Required:

a.Compute the sales volume necessary to achieve a 20% ROI.

b.The division manager receives a bonus of 50% of residual income. What is his anticipated bonus for 2015, assuming he achieves the 20% ROI from part (a)?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q130: An important consideration in designing compensation arrangements

Q131: LaserLife Printer Cartridge Company is a decentralized

Q132: Which of the following is true of

Q133: Which of the following is a difference

Q134: There should be strict congruence between the

Q136: Which of the following is true of

Q137: A manager's job entails gathering information, interpreting

Q138: Executive compensation plans are based on both

Q139: Which of the following best describes a

Q140: "Levers of control," in addition to a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents