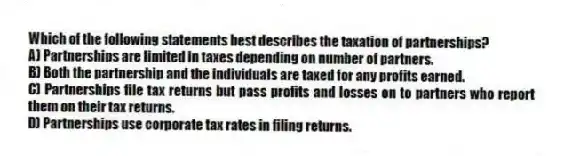

Which of the following statements best describes the taxation of partnerships?

A) Partnerships are limited in taxes depending on number of partners.

B) Both the partnership and the individuals are taxed for any profits earned.

C) Partnerships file tax returns but pass profits and losses on to partners who report them on their tax returns.

D) Partnerships use corporate tax rates in filing returns.

Correct Answer:

Verified

Q20: Al Tomlin and Wilson Nkata recently closed

Q21: Rama Singh and Allie Jordan are opening

Q22: Which of the following statements best describes

Q23: What do partnership agreements generally specify?

A) the

Q24: Sam Beauvois has invested $10,000 in his

Q26: Karl Metzger plans to invest $5,000 in

Q27: Thom Georges wants to open a store

Q28: What is the biggest difference between a

Q29: Ease of formation, flexibility, and diversity of

Q30: What are companies that are traded on

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents