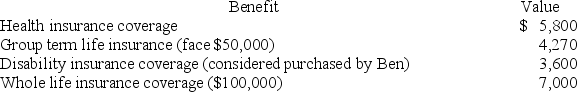

Ben's employer offers employees the following benefits.What amount must Ben include in his gross income?

A) $9,400

B) $11,070

C) $10,600

D) $7,000

E) Zero - none of the benefits is included in gross income.

Correct Answer:

Verified

Q86: This year, Barney and Betty sold their

Q93: Sam, age 45, saved diligently for his

Q95: Graham has accepted an offer to do

Q96: Mike received the following interest payments this

Q98: Frank received the following benefits from his

Q102: In April of this year Victoria received

Q103: Samantha was ill for four months this

Q124: This year Larry received the first payment

Q131: Blake is a limited partner in Kling-On

Q157: J.Z.(single taxpayer)is retired and received $10,000 of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents