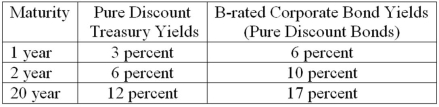

The following represents two yield curves.  What interest rate is expected on a one-year B-rated corporate bond in one year? (Hint: Use the implied forward rate.)

What interest rate is expected on a one-year B-rated corporate bond in one year? (Hint: Use the implied forward rate.)

A) 10.0 percent.

B) 9.09 percent.

C) 14.15 percent.

D) 12.0 percent.

E) 17.0 percent.

Correct Answer:

Verified

Q86: Which of the following is NOT a

Q88: If the spot interest rate on a

Q90: Suppose that the financial ratios of a

Q91: The following information on the mortality rate

Q93: Using a modified discriminant function similar to

Q94: The following represents two yield curves.

Q95: What is the essential idea behind RAROC?

A)Evaluating

Q95: Cumulative default probability refers to

A)probability that a

Q98: The following represents two yield curves.

Q100: Using a modified discriminant function similar to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents