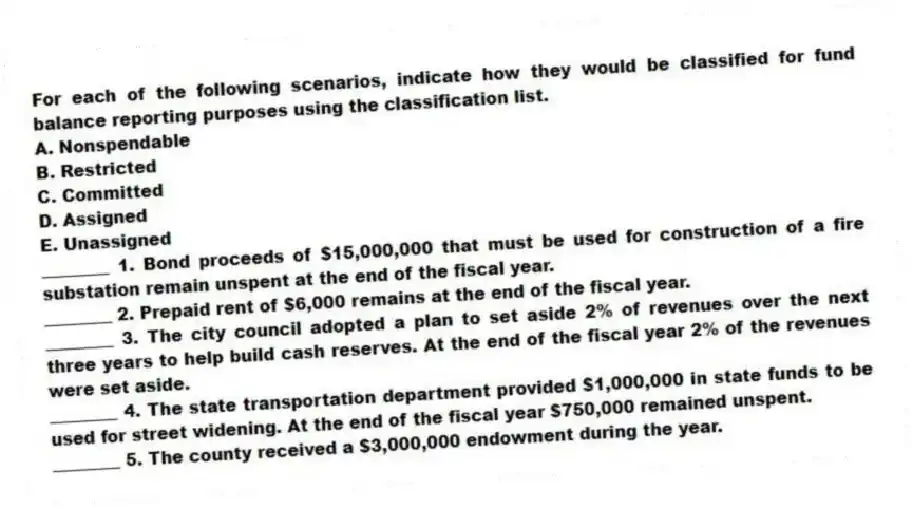

For each of the following scenarios, indicate how they would be classified for fund balance reporting purposes using the classification list.

A. Nonspendable

B. Restricted

C. Committed

D. Assigned

E. Unassigned

________ 1. Bond proceeds of $15,000,000 that must be used for construction of a fire substation remain unspent at the end of the fiscal year.

________ 2. Prepaid rent of $6,000 remains at the end of the fiscal year.

________ 3. The city council adopted a plan to set aside 2% of revenues over the next three years to help build cash reserves. At the end of the fiscal year 2% of the revenues were set aside.

________ 4. The state transportation department provided $1,000,000 in state funds to be used for street widening. At the end of the fiscal year $750,000 remained unspent.

________ 5. The county received a $3,000,000 endowment during the year.

Correct Answer:

Verified

2. ...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q63: Which of the following is not one

Q64: The GASB concept statements indicate that in

Q65: The GASB recommends that budget-to-actual comparison information

Q66: Explain the difference between measurement focus and

Q67: For each of the following descriptive phrases,

Q68: "The primary purpose of an accounting system

Q69: List the seven fund financial statements that

Q70: Use the following information to determine

Q72: The GASB requires budget-to-actual comparison information for

Q73: List the basic financial statements required by

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents