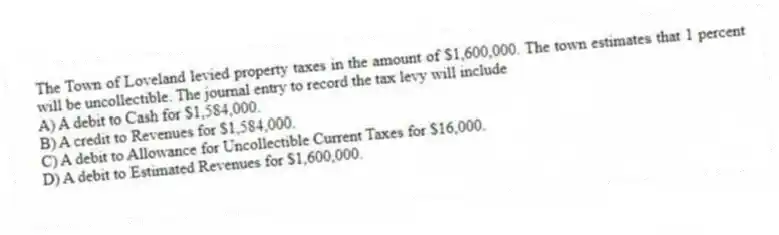

The Town of Loveland levied property taxes in the amount of $1,600,000. The town estimates that 1 percent will be uncollectible. The journal entry to record the tax levy will include

A) A debit to Cash for $1,584,000.

B) A credit to Revenues for $1,584,000.

C) A debit to Allowance for Uncollectible Current Taxes for $16,000.

D) A debit to Estimated Revenues for $1,600,000.

Correct Answer:

Verified

Q20: Current financial resources include cash and items

Q21: All amounts due to or from other

Q22: A properly prepared schedule of revenues, expenditures,

Q23: Encumbrance accounts need not be closed at

Q24: Grant funds received before time requirements are

Q26: Which of the following should not be

Q27: Permanent funds use the modified accrual basis

Q28: Some governments choose to sell the collection

Q29: Year-end interfund receivable or payable balances will

Q30: At the end of the fiscal year,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents