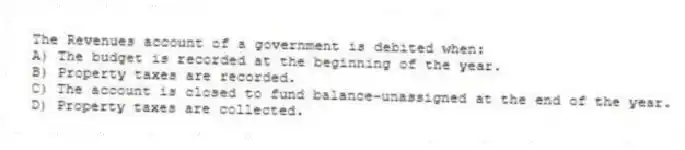

The Revenues account of a government is debited when:

A) The budget is recorded at the beginning of the year.

B) Property taxes are recorded.

C) The account is closed to fund balance-unassigned at the end of the year.

D) Property taxes are collected.

Correct Answer:

Verified

Q46: The Estimated Revenues account of a government

Q47: When a fire truck purchased from General

Q48: Which of the following accounts would not

Q49: The General Fund used electricity provided by

Q50: Which of the following would be considered

Q52: Vacation City was awarded a $500,000 federal

Q53: Property taxes due and collectible 90 days

Q54: The City of Island Grove uses encumbrance

Q55: Which of the following would properly be

Q56: Which of the following will require a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents