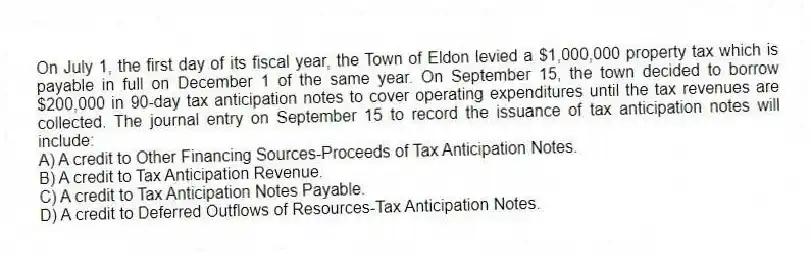

On July 1, the first day of its fiscal year, the Town of Eldon levied a $1,000,000 property tax which is payable in full on December 1 of the same year. On September 15, the town decided to borrow $200,000 in 90-day tax anticipation notes to cover operating expenditures until the tax revenues are collected. The journal entry on September 15 to record the issuance of tax anticipation notes will include:

A) A credit to Other Financing Sources-Proceeds of Tax Anticipation Notes.

B) A credit to Tax Anticipation Revenue.

C) A credit to Tax Anticipation Notes Payable.

D) A credit to Deferred Outflows of Resources-Tax Anticipation Notes.

Correct Answer:

Verified

Q53: Property taxes due and collectible 90 days

Q54: The City of Island Grove uses encumbrance

Q55: Which of the following would properly be

Q56: Which of the following will require a

Q57: During January 2020 General Fund supplies ordered

Q59: On May 1, the City of Dustin

Q60: Which of the following best describes the

Q61: The city's electric utility fund sent $700,000

Q62: The earnings on the assets of a

Q63: Which of the following types of nonexchange

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents