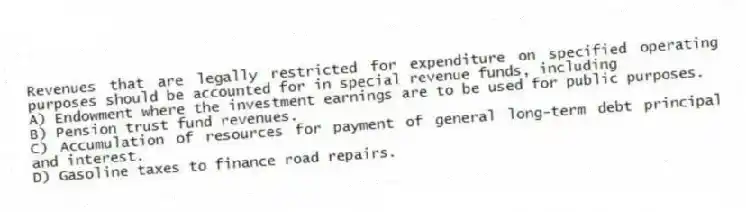

Revenues that are legally restricted for expenditure on specified operating purposes should be accounted for in special revenue funds, including

A) Endowment where the investment earnings are to be used for public purposes.

B) Pension trust fund revenues.

C) Accumulation of resources for payment of general long-term debt principal and interest.

D) Gasoline taxes to finance road repairs.

Correct Answer:

Verified

Q65: The governmental funds operating statement presents all

Q66: At the end of the 2020 fiscal

Q67: Which of the following transactions is classified

Q68: If a governmental fund issues debt to

Q69: Which of the following would be reported

Q71: Which of the following is not a

Q72: The county received a $10,000,000 endowment, the

Q73: In fiscal year 2020 the "Expenditures-2019" account

Q74: If state law requires that local governments

Q75: Under the consumption method for recording supplies

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents