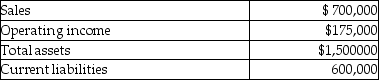

The Box Manufacturing Division of the Allied Paper Company reported the following results from the past year. Shareholders require a return of 7%. Management calculated a weighted-average cost of capital (WACC) of 5%. Allied's corporate tax rate is 30%.  What is the division's Residual Income (RI) ?

What is the division's Residual Income (RI) ?

A) $70,000

B) $77,500

C) $100,000

D) 126,000

Correct Answer:

Verified

Q103: Pigeon Forges' stakeholders require a 10% rate

Q104: Dove Incorporated has operating income of $650,000,a

Q106: The Box Manufacturing Division of the Allied

Q107: The Box Manufacturing Division of the Allied

Q108: Fern Company has a target rate of

Q109: Lewis Company has operating income of $336,000.

Q109: For the most recent year,Robin Company reports

Q111: Kleeman Company has a sales margin of

Q112: Assume the Air Conditioning division of the

Q114: Camden Corporation has operating income of $87,000,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents