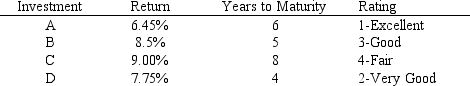

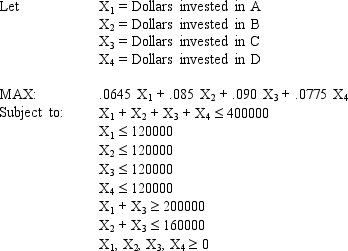

A financial planner wants to design a portfolio of investments for a client. The client has $400,000 to invest and the planner has identified four investment options for the money. The following requirements have been placed on the planner. No more than 30% of the money in any one investment, at least one half should be invested in long-term bonds which mature in six or more years, and no more than 40% of the total money should be invested in B or C since they are riskier investments. The planner has developed the following LP model based on the data in this table and the requirements of the client. The objective is to maximize the total return of the portfolio.

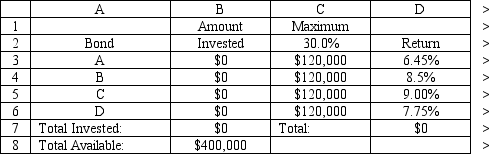

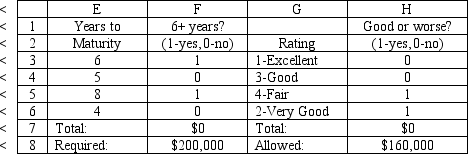

What values would you enter in the Risk Solver Platform (RSP) task pane for the following cells for this Excel spreadsheet implementation of this problem?

What values would you enter in the Risk Solver Platform (RSP) task pane for the following cells for this Excel spreadsheet implementation of this problem?

Objective Cell:

Variables Cells:

Constraints Cells:

Correct Answer:

Verified

Q74: A financial planner wants to design a

Q75: A farmer is planning his spring planting.

Q76: A farmer is planning his spring planting.

Q77: A hospital needs to determine how many

Q78: A grain store has six types of

Q80: A farmer is planning his spring planting.

Q81: The hospital administrators at New Hope, County

Q82: Carlton construction is supplying building materials for

Q83: The hospital administrators at New Hope, County

Q84: Carlton construction is supplying building materials for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents