The following questions are based on the problem below.

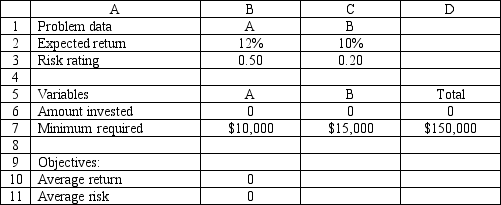

An investor has $150,000 to invest in investments A and B. Investment A requires a $10,000 minimum investment, pays a return of 12% and has a risk factor of .50. Investment B requires a $15,000 minimum investment, pays a return of 10% and has a risk factor of .20. The investor wants to maximize the return while minimizing the risk of the portfolio. The following multi-objective linear programming (MOLP) has been solved in Excel.

-Refer to Exhibit 7.2. What Risk Solver Platform (RSP) constraint involves cells $B$6:$C$6?

A) $B$6:$C$6=$B$7:$C$7

B) $B$6:$C$6 $B$7:$C$7

C) $B$6:$C$6 $B$7:$C$7

D) $B$6:$C$6=$D$7

Correct Answer:

Verified

Q1: An optimization technique useful for solving problems

Q12: The decision maker has expressed concern with

Q34: The primary benefit of a MINIMAX objective

Q35: Exhibit 7.1

The following questions are based on

Q36: Given the following goal constraints

5 X1 +

Q42: A company makes 2 products A and

Q45: MINIMAX solutions to multi-objective linear programming (MOLP)

Q55: Exhibit 7.1

The following questions are based on

Q61: Exhibit 7.4

The following questions are based on

Q80: Exhibit 7.4

The following questions are based on

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents