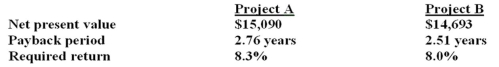

Matt is analyzing two mutually exclusive projects of similar size and has prepared the following data. Both projects have 5 year lives. Matt has been asked for his best recommendation given this information. His recommendation should be to accept:

A) project B because it has the shortest payback period.

B) both projects as they both have positive net present values.

C) project A and reject project B based on their net present values.

D) project B and reject project A based on other criteria not mentioned in the problem.

E) project B and reject project A based on both the payback period and the average accounting return.

Correct Answer:

Verified

Q31: If you want to review a project

Q32: The profitability index is closely related to:

A)

Q33: The discounted payback rule may cause:

A) some

Q34: Which one of the following is the

Q35: When two projects both require the total

Q37: No matter how many forms of investment

Q38: The internal rate of return tends to

Q39: Graphing the NPVs of mutually exclusive projects

Q40: You are trying to determine whether to

Q41: The problem of multiple IRRs can occur

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents