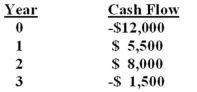

You are considering an investment with the following cash flows. If the required rate of return for this investment is 13.5%,should you accept it based solely on the internal rate of return rule? Why or why not?

A) Yes; because the IRR exceeds the required return.

B) Yes; because the IRR is a positive rate of return.

C) No; because the IRR is less than the required return.

D) No; because the IRR is a negative rate of return.

E) You can not apply the IRR rule in this case because there are multiple IRRs.

Correct Answer:

Verified

Q61: Jack is considering adding toys to his

Q62: You are considering two independent projects both

Q63: You are analyzing two mutually exclusive projects

Q64: What is the internal rate of return

Q65: What is the net present value of

Q67: Homer is considering a project which will

Q68: An investment has the following cash flows.

Q69: You are considering a project with an

Q70: You would like to invest in the

Q71: A project has an initial cost of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents