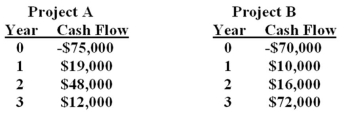

You are considering the following two mutually exclusive projects. Both projects will be depreciated using straight-line depreciation to a zero book value over the life of the project. Neither project has any salvage value.  Required rate of return 10% 13%

Required rate of return 10% 13%

Required payback period 2.0 years 2.0 years

Based upon the internal rate of return (IRR) and the information provided in the problem,you should:

A) accept both project A and project B.

B) reject both project A and project B.

C) accept project A and reject project B.

D) accept project B and reject project A.

E) ignore the IRR rule and use another method of analysis.

Correct Answer:

Verified

Q79: Based on the profitability index (PI) rule,should

Q80: What is the net present value of

Q81: You are analyzing a project and have

Q82: An investment with an initial cost of

Q83: An investment cost $10,000 with expected cash

Q85: You are analyzing a project and have

Q86: You are considering the following two mutually

Q87: You are considering the following two mutually

Q88: Consider an investment with an initial cost

Q89: An investment cost $12,000 with expected cash

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents