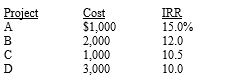

Takeda Enterprises has four investment opportunities with the following costs (all costs are paid at t = 0) and estimated internal rates of return (IRR) :  The company wants to maintain a capital structure of 50 percent debt and 50 percent equity.The company anticipates that it can issue up to $2,000 of debt at an interest rate of 10 percent;if it issues more than $2,000 of debt its interest rate will increase to 11 percent.The company's stock price (P0) is currently $90 per share,its expected dividend (

The company wants to maintain a capital structure of 50 percent debt and 50 percent equity.The company anticipates that it can issue up to $2,000 of debt at an interest rate of 10 percent;if it issues more than $2,000 of debt its interest rate will increase to 11 percent.The company's stock price (P0) is currently $90 per share,its expected dividend (  ) is $6,and its dividend growth rate is 5 percent.The company expects to have $3,000 in retained earnings and its tax rate is 30 percent.What percentage flotation cost makes the net present value of accepting Project D zero?

) is $6,and its dividend growth rate is 5 percent.The company expects to have $3,000 in retained earnings and its tax rate is 30 percent.What percentage flotation cost makes the net present value of accepting Project D zero?

(Hint: Project D will be selected only after Projects A,B,and C have been selected. )

A) 18.77%

B) 22.12%

C) 24.10%

D) 27.33%

E) 30.25%

Correct Answer:

Verified

Q18: Which of the following statements is most

Q19: Which of the following statements is most

Q20: Which of the following statements is most

Q21: Your company's stock sells for $50 per

Q22: Company can't lower its total cost of

Q24: Global Advertising Company

The Global Advertising Company had

Q25: S.Claus & Company is planning a zero

Q26: Gulf Electric Company (GEC)

Gulf Electric Company (GEC)

Q27: Tapley Inc.'s current (target)capital structure has a

Q28: Heavy Metal Corp.is a steel manufacturer that

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents