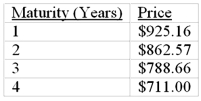

The following is a list of prices for zero-coupon bonds with different maturities and par value of $1,000.  You have purchased a 4-year maturity bond with a 9% coupon rate paid annually.The bond has a par value of $1,000.What would the price of the bond be one year from now if the implied forward rates stay the same

You have purchased a 4-year maturity bond with a 9% coupon rate paid annually.The bond has a par value of $1,000.What would the price of the bond be one year from now if the implied forward rates stay the same

A) $995.63

B) $1,108.88

C) $1,000.00

D) $1,042.78

Correct Answer:

Verified

Q32: The yield curve

A) is a graphical depiction

Q37: The following is a list of prices

Q38: An upward sloping yield curve

A)may be an

Q39: When computing yield to maturity, the implicit

Q41: Although the expectations of increases in future

Q43: Explain what the following terms mean: spot

Q45: Term Structure of Interest Rates is the

Q46: The following is a list of prices

Q47: Answer the following questions that relate to

Q56: Given the yield on a 3-year zero-coupon

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents