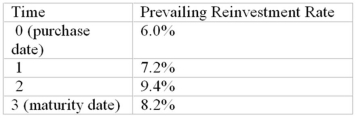

Three years ago you purchased a bond for $974.69.The bond had three years to maturity, a coupon rate of 8%, paid annually, and a face value of $1,000.Each year you reinvested all coupon interest at the prevailing reinvestment rate shown in the table below.Today is the bond's maturity date.What is your realized compound yield on the bond

A) 6.43%

B) 7.96%

C) 8.23%

D) 8.97%

E) 9.13%

Correct Answer:

Verified

Q78: A 10% coupon, annual payments, bond maturing

Q79: A bond will sell at a discount

Q79: Most corporate bonds are traded

A) on a

Q80: The yield to maturity of a 20-year

Q82: A coupon bond that pays interest annually

Q83: Bond analysts might be more interested in

Q84: Subordination clauses in bond indentures

A)may restrict the

Q85: When a bond indenture includes a sinking

Q86: A coupon bond that pays interest semi-annually

Q97: Debt securities are often called fixed-income securities

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents