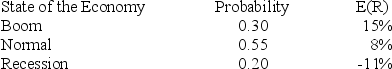

The risk-free rate is 3.5 percent.What is the expected risk premium on this security given the following information?

A) 2.09 percent

B) 3.01 percent

C) 3.20 percent

D) 3.87 percent

E) 4.15 percent

Correct Answer:

Verified

Q23: You are graphing the investment opportunity set

Q44: What is the expected return on this

Q45: What is the expected return on this

Q46: What is the expected return on this

Q47: What is the variance of the returns

Q49: You combine a set of assets using

Q50: What is the variance of the expected

Q51: The risk-free rate is 4.15 percent.What is

Q52: There is a 35 percent probability that

Q53: What is the variance of the returns

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents