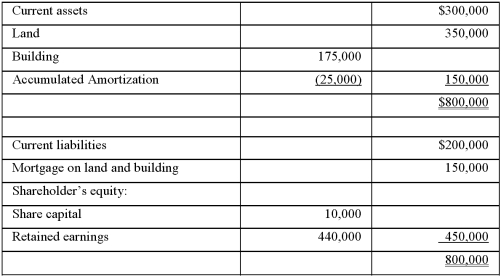

Mountain Wear Inc.(MWI)is a Canadian-controlled private corporation owned 100% by Fred Martin.The ACB of Fred's shares in MWI is $10,000.The year-end balance sheet for MWI is as follows:  Additional information is available for MWI:

Additional information is available for MWI:

The current assets consist of accounts receivables and inventory,which have costs equal to their market values.

The UCC of the building is $160,000.

The land is currently valued at $450,000.

The building has a FMV of $205,000.

Additionally:

Fred has used all of his capital gains exemption.

MWI is not associated with any other corporations for tax purposes.

Fred has recently been offered $450,000 for his shares by a local competitor.

Fred is in a 45% tax bracket.

Due to the timing of the sale,if assets are sold,the small business deduction will be available.

Assume a 15% tax rate on earnings subject to the small business deduction.

Assume a combined 44 2/3% tax rate on corporate investment income.

Required:

A)Calculate the after-tax proceeds of the sale if the shares of MWI are sold.

B)Calculate the amount of proceeds available for distribution if the assets of MWI are sold.

C)If the proceeds are distributed in a wind-up,what type of taxes will Fred be subject to? (It is not necessary to show calculations for this part of the question.)

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: ABC Inc.(a CCPC)is for sale,and Jane,the sole

Q2: When deciding whether to purchase the shares

Q3: The Flower Company is for sale.The anticipated

Q4: Stick Co.owns land with a fair market

Q6: Sam Sherwood wishes to purchase Kitchen Cabinets,Inc.(KCI),from

Q7: Identify the tax effects for 1)the vendor

Q8: A purchaser has agreed to purchase all

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents