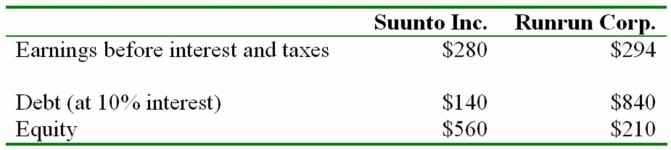

Answer the questions below based on the following information.Taxes are 35% and all dollars are in millions.

a)Calculate each company's ROE,ROA,and ROIC.

a)Calculate each company's ROE,ROA,and ROIC.

b)Why is Runrun's ROE so much higher than Suunto's?

Does this mean Runrun is a better company?

Why or why not?

c)Why is Suunto's ROA higher than Runrun's?

What does this tell you about the two companies?

d)How do the two companies' ROICs compare?

What does this suggest about the two companies?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q13: Selected financial data for Link, Inc. follows:

Q14: Breakers Bay Inc.has succeeded in increasing the

Q15: The most popular yardstick of financial performance

Q16: Selected financial data for Link, Inc. follows:

Q18: Which of these ratios,or levers of performance,are

Q19: Which one of the following statements is

Q20: Selected financial data for Link, Inc. follows:

Q21: The financial statements for Limited Brands, Inc.

Q22: The financial statements for Limited Brands, Inc.

Q30: Which one of the following statements does

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents