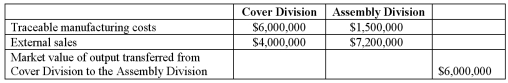

Simmons Bedding Company manufactures an array of bedding-related products, including pillows. The Cover Division of Simmons makes covers, while the Assembly Division of the company produces finished pillows. The covers can be sold separately for $10.00 a piece, while the pillows sell for $12.00 per unit. For performance-evaluation purposes, these two divisions are treated as investment centers. Financial results from the most recent accounting period are as follows:

Required:

Required:

1. What is the operating income for each of the two divisions and for the company as a whole? (Use market value as the transfer price.)

2. Do you think each of the two divisional managers is happy with this transfer-pricing method? Explain.

Correct Answer:

Verified

Feedback:

1.

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q121: What special problems and opportunities arise in

Q122: The following questions pertain to the process

Q124: The text presents what it calls a

Q126: What are the principal advantages and disadvantages

Q132: When the Bronx Company formed three divisions

Q132: Edwards Inc. manufactures electronics. It consists of

Q134: Assume two divisions, P (producing) and B

Q135: Brown's Mill has two operating units, each

Q135: Pearl Inc. has the following financial results

Q137: As noted in the text, the use

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents