Thomlinson Company is considering the development of two products: no.65 or no.66.Manufacturing cost information follows.

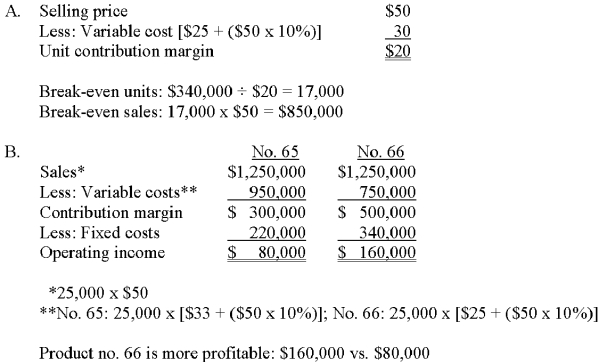

A.What is the break-even sales volume (in dollars)on product no.66?

B.Which of the two products will be more profitable at a sales level of 25,000 units?

C.At what unit-volume level will the profit/loss on product no.65 equal the profit/loss on product no.66?

C.X = Number of units

($50 - $38)X - $220,000 = ($50 - $30)X - $340,000

$12X - $220,000 = $20X - $340,000

$8X = $120,000

X = 15,000 units

Correct Answer:

Verified

Regardless of which product is introdu...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q67: The assumptions on which cost-volume-profit analysis is

Q79: Miller Company has an operating leverage factor

Q81: Brice Publications,Inc.produces and sells business books.The results

Q82: Barrey,Inc.is subject to a 40% income tax

Q83: Many firms are moving toward flexible manufacturing

Q85: Goldstone Company is studying the impact of

Q87: Elmton recently sold 70,000 units,generating sales revenue

Q88: The Braggs & Struttin' Company manufactures an

Q89: Barrey,Inc.is subject to a 40% income tax

Q99: A company, subject to a 40% tax

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents