Ai Corporation extracts ore for eight different companies in Colorado.The firm anticipates variable costs of $65 per ton along with annual fixed overhead of $840,000,which is incurred evenly throughout the year.These costs exclude the following semivariable costs,which are expected to total the amounts shown for the high and low points of ore extraction activity:

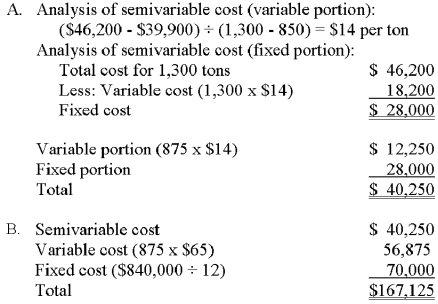

March (850 tons): $39,900

August (1,300 tons): $46,200

A-1 uses the high-low method to analyze cost behavior.

Required:

A.Calculate the semivariable cost for an upcoming month when 875 tons will be extracted.

B.Calculate the total cost for that same month.

C.1.Step-fixed.

2.No.Notice that the bill will be $70,000 for A-1's tonnage,and the company could have Cortez haul up to 1,099 tons for the same cost.Ideally,Ai should try to move to the right side of the step to get a better return on its investment.

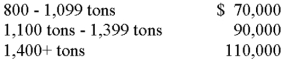

C.Ai uses Cortez Trucking to haul extracted ore.Cortez's monthly charges are as follows:

1.From a cost behavior perspective,what type of cost is this?

2.If Ai plans to extract 875 tons,is the company being very "cost effective" with respect to Cortez's billing rates? Briefly discuss.

Correct Answer:

Verified

1.From a cost behavior perspective,wha...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q60: Which type of fixed cost (1)tends to

Q61: The cost formula that expresses the behavior

Q62: Wesley Enterprises has determined that three variables

Q63: A high R2 measure in regression analysis

Q63: Booster, Inc. recently conducted a least-squares regression

Q64: Temperance,Inc.is studying marketing cost and sales volume,and

Q66: Mohammed Products has determined that the number

Q68: Package Express, Inc. operates a small package

Q70: The cost types shown above are identified

Q78: Around Town, Inc. operates a small package

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents