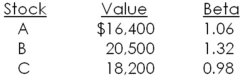

Currently,you own a portfolio comprised of the following three securities.How much of the riskiest security should you sell and replace with risk-free securities if you want your portfolio beta to equal 90 percent of the market beta?

A) $7,023.15

B) $7,811.29

C) $8,666.67

D) $9,613.64

E) $10,318.50

Correct Answer:

Verified

Q65: You currently own a portfolio valued at

Q66: You would like to invest $19,000 and

Q67: Given the following information,what is the standard

Q68: You want to create a $48,000 portfolio

Q69: Given the following information,what is the expected

Q71: You want to create a $65,000 portfolio

Q72: Given the following information,what is the variance

Q73: Given the following information,what is the standard

Q74: You would like to create a portfolio

Q75: What is the beta of the following

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents