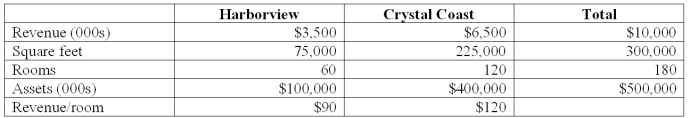

SeaScape Resorts owns and operates two resorts in a coastal town.Both resorts are located on a barrier island that is connected to the mainland by a high bridge.One resort is located on the beach and is called the Crystal Coast Resort.The other resort is located on the inland waterway which passes between the town and the mainland;it is called the Harborview Resort.Some key information about the two resorts for the current year is shown below.

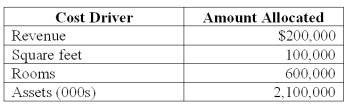

The nontraceable operating costs of the resort amount to $3 million.By careful study,the management accountant at SeaScape has determined that,while the costs are not directly traceable,the total of $3 million could be fairly allocated to the four cost drivers as follows.

What is the operating profit of the Crystal Coast Resort,using revenue as an allocation base?

A) $2,450,000

B) $1,600,000

C) $1,500,000

D) $4,550,000

E) $3,550,000

Correct Answer:

Verified

Q89: Treble Inc. planned and manufactured 250,000 units

Q90: Controllable fixed costs:

A) Are those costs that

Q95: The cost method that is input-oriented and

Q98: The type of strategic business unit (SBU)

Q100: Under the principal-agent model of contract relationships,

Q103: Reasons for failure to implement the balanced

Q105: Betty Jones and Penny White are associates

Q106: SeaScape Resorts owns and operates two resorts

Q121: Red Apple Industries manufactures institutional-use furniture. Dept.

Q122: Doctors Health Care System has integrated health

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents