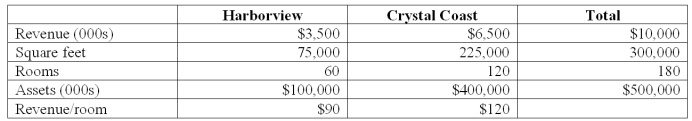

SeaScape Resorts owns and operates two resorts in a coastal town.Both resorts are located on a barrier island that is connected to the mainland by a high bridge.One resort is located on the beach and is called the Crystal Coast Resort.The other resort is located on the inland waterway which passes between the town and the mainland;it is called the Harborview Resort.Some key information about the two resorts for the current year is shown below.

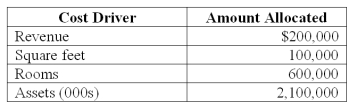

The nontraceable operating costs of the resort amount to $3 million.By careful study,the management accountant at SeaScape has determined that,while the costs are not directly traceable,the total of $3 million could be fairly allocated to the four cost drivers as follows.

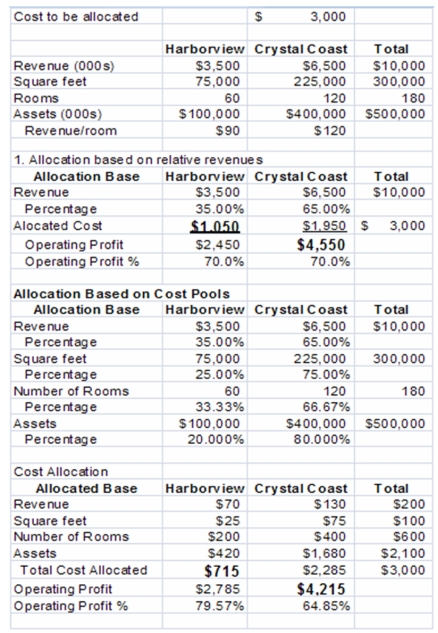

The Crystal Coast resort is likely to be favored in terms of a lower cost allocation under:

A) Revenue-based allocation.

B) Cost-driver based allocation.

C) Cannot be determined from the information.

D) Would be the same for both allocation methods.

Because of the large amount of cost associated with the assets cost driver and because the Crystal Coast resort has a far higher proportion of the total assets,the revenue based allocation is likely to favor the Crystal Coast Resort.

Calculations for 111 (in 000s) :

Correct Answer:

Verified

Q110: McShane Inc.manufactures hair brushes that sell at

Q110: Sand and Sea Resorts owns and

Q111: Divisional managers of SIU Incorporated have been

Q111: The sales life cycle has three phases:

Q113: The Daniels Tool & Die Corporation has

Q115: SeaScape Resorts owns and operates two resorts

Q116: Managers who are risk prone:

A)Seek risky projects

Q118: Tyler Company had the following manufacturing information

Q119: Red Apple Industries manufactures institutional-use furniture.Dept.A is

Q130: The Daniels Tool & Die Corporation

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents