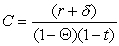

Assume that the user cost of capital (C)is simply

where r is the after tax rate of return,δ is the depreciation rate,Θ is the corporate tax rate and,r is the individual tax rate.Now assume further that the after?tax rate of return is 10 percent and the economic depreciation rate is 2 percent.The firm faces corporate taxes of 35 percent with an individual tax rate of 25 percent.What is the user cost of capital in this case?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q8: Firms use the discount rate to

A) compute

Q15: Economic depreciation is

A) the change in the

Q17: Before applying the 35 percent tax rate,firms

Q20: Interest deductibility does not provide an incentive

Q21: Profits earned by subsidiary are taxed even

Q22: Oxnard Rims,Inc.,has $5 million in assets and

Q23: Suppose you are only concerned with national

Q25: A proprietorship is one with a single

Q27: Corporations,like individuals,face an alternative minimum tax (AMT).

Q29: Your textbook highlights a debate that has

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents