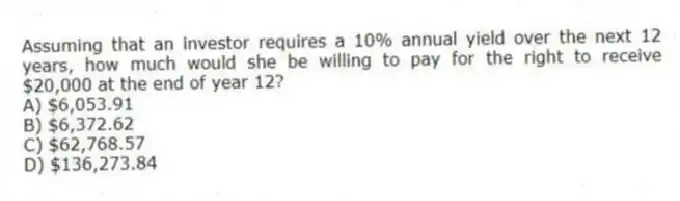

Assuming that an investor requires a 10% annual yield over the next 12 years, how much would she be willing to pay for the right to receive $20,000 at the end of year 12?

A) $6,053.91

B) $6,372.62

C) $62,768.57

D) $136,273.84

Correct Answer:

Verified

Q7: The internal rate of return (IRR) and

Q8: The Real Estate Research Corporation (RERC) regularly

Q9: Suppose an investor deposits $2500 in an

Q10: Since investors prefer to have money now

Q11: Suppose that a landlord is interested in

Q13: Assume that an industrial building can be

Q14: With compound interest, the investor earns interest

Q15: An investor agreed to sell a warehouse

Q16: Assume that an individual puts $10,000 into

Q17: Assuming all else the same, the _

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents