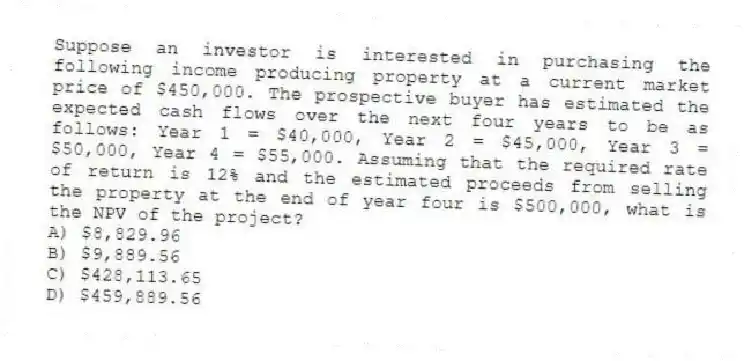

Suppose an investor is interested in purchasing the following income producing property at a current market price of $450,000. The prospective buyer has estimated the expected cash flows over the next four years to be as follows: Year 1 = $40,000, Year 2 = $45,000, Year 3 = $50,000, Year 4 = $55,000. Assuming that the required rate of return is 12% and the estimated proceeds from selling the property at the end of year four is $500,000, what is the NPV of the project?

A) $8,829.96

B) $9,889.56

C) $428,113.65

D) $459,889.56

Correct Answer:

Verified

Q1: The rate that is used to discount

Q2: The purchase price of an income producing

Q3: Risk is the possibility that actual outcomes

Q4: Assume that a piece of land is

Q5: Which of the following terms refers to

Q7: The internal rate of return (IRR) and

Q8: The Real Estate Research Corporation (RERC) regularly

Q9: Suppose an investor deposits $2500 in an

Q10: Since investors prefer to have money now

Q11: Suppose that a landlord is interested in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents