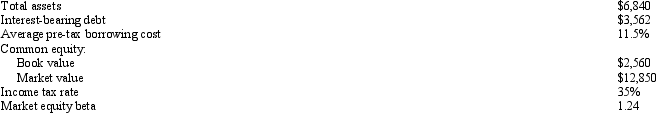

Zonk Corp. The following data pertains to Zonk Corp.,a manufacturer of ball bearings (dollar amounts in millions) : Using the above information,calculate Zonk's weighted-average cost of capital:

Using the above information,calculate Zonk's weighted-average cost of capital:

A) 11.5%

B) 11.89%

C) 7.48%

D) 10.90%

Correct Answer:

Verified

Q2: Returns on systematic risk-free securities (like U.S.Treasury

Q2: Zonk Corp.

The following data pertains to

Q4: The historical discount rate of the firm

Q5: With respect to dividends and priority in

Q10: Under the cash-flow-based valuation approach,free cash flows

Q10: Firm-specific factors that increase the firm's nondiversifiable

Q11: Zonk Corp. The following data pertains to

Q14: Zonk Corp. The following data pertains to

Q20: All of the following are steps in

Q37: In what case will using dividends expected

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents