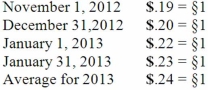

A subsidiary of Porter Inc., a U.S. company, was located in a foreign country. The functional currency of this subsidiary was the Stickle (§) , the local currency where the subsidiary is located. The subsidiary acquired inventory on credit on November 1, 2012, for §120,000 that was sold on January 17, 2013 for §156,000. The subsidiary paid for the inventory on January 31, 2013. Currency exchange rates between the dollar and the Stickle were as follows:  What amount would have been reported for cost of goods sold on Porter's consolidated income statement at December 31, 2013?

What amount would have been reported for cost of goods sold on Porter's consolidated income statement at December 31, 2013?

A) $24,000.

B) $26,400.

C) $22,800.

D) $27,600.

E) $28,800.

Correct Answer:

Verified

Q1: A subsidiary of Porter Inc., a U.S.

Q2: According to U.S. GAAP for a local

Q4: Westmore Ltd., is a British subsidiary

Q5: Darron Co. was formed on January 1,

Q7: For a foreign subsidiary that uses the

Q9: Sinkal Co. was formed on January 1,

Q10: Darron Co. was formed on January 1,

Q17: Which accounts are remeasured using current exchange

Q18: In accounting, the term translation refers to

A)

Q19: Dilty Corp. owned a subsidiary in France.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents