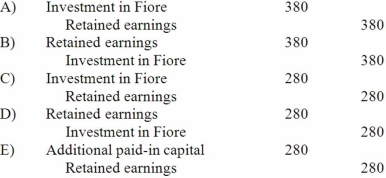

Kaye Company acquired 100% of Fiore Company on January 1, 2013. Kaye paid $1,000 excess consideration over book value which is being amortized at $20 per year. Fiore reported net income of $400 in 2013 and paid dividends of $100. Assume the initial value method is used. In the year subsequent to acquisition, what additional worksheet entry must be made for consolidation purposes that is not required for the equity method?

A) Entry A.

B) Entry B.

C) Entry C.

D) Entry D.

E) Entry E.

Correct Answer:

Verified

Q43: Kaye Company acquired 100% of Fiore Company

Q56: Perry Company acquires 100% of the

Q57: Perry Company acquires 100% of the

Q58: Perry Company acquires 100% of the

Q59: Kaye Company acquired 100% of Fiore Company

Q60: Perry Company acquires 100% of the

Q61: Following are selected accounts for Green

Q66: How is the fair value allocation of

Q72: Beatty, Inc. acquires 100% of the voting

Q75: Beatty, Inc. acquires 100% of the voting

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents