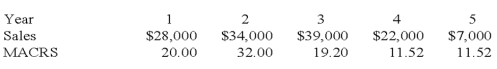

The Blue Lagoon is considering a project with a five-year life. The project requires $110,000 of fixed assets that are classified as five-year property for MACRS. Variable costs equal 71 percent of sales, fixed costs are $9,600, and the tax rate is 35 percent. What is the operating cash flow for year 4 given the following sales estimates and MACRS depreciation allowance percentages?

A) -$1,806

B) $640

C) $1,809

D) $2,342

E) $2,811

Correct Answer:

Verified

Q57: Turner Industries started a new project three

Q59: Great Woods sells specialty equipment for mountain

Q62: A cost-cutting project will decrease costs by

Q63: An all-equity firm has net income of

Q65: A project requires $336,000 of equipment that

Q66: A project has an annual operating cash

Q67: What is the year two depreciation on

Q68: Hi Fliers is considering making and selling

Q76: Your local athletic center is planning a

Q79: Burke's Corner currently sells blue jeans and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents