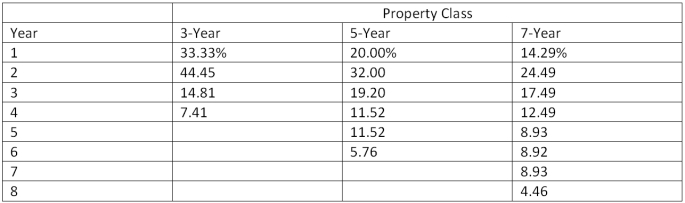

Boyertown Industrial Tools is considering a 3-year project to improve its production efficiency. Buying a new machine press for $611,000 is estimated to result in $193,000 in annual pretax cost savings. The press falls in the MACRS five-year class, and it will have a salvage value at the end of the project of $162,000. The press also requires an initial investment in spare parts inventory of $19,000, along with an additional $2,000 in inventory for each succeeding year of the project. If the tax rate is 35 percent and the discount rate is 12 percent, should the company buy and install the machine press? Why or why not?  Table 9.7 Modified ACRS depreciation allowances

Table 9.7 Modified ACRS depreciation allowances

A) Yes; the NPV is $51,613

B) Yes: the NPV is $45,607

C) No; the NPV is -$22,311

D) No; the NPV is -$52,918

E) No; the NPV is -$74,945

Correct Answer:

Verified

Q101: Your firm is contemplating the purchase of

Q102: Consider an asset that costs $459,000 and

Q103: Consider a 3-year project with the following

Q104: Industrial Machines has the following estimates for

Q105: We are evaluating a project that costs

Q106: Miller's, Inc. is considering a new 4-year

Q107: An asset used in a 3-year project

Q108: The Sausage Hut is looking at a

Q108: Identify three managerial options that relate to

Q110: Travel Coaches currently sells 14,000 motor homes

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents