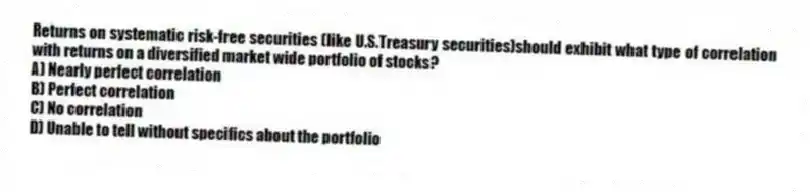

Returns on systematic risk-free securities (like U.S.Treasury securities) should exhibit what type of correlation with returns on a diversified market wide portfolio of stocks?

A) Nearly perfect correlation

B) Perfect correlation

C) No correlation

D) Unable to tell without specifics about the portfolio

Correct Answer:

Verified

Q4: Which of the following is not a

Q5: With respect to dividends and priority in

Q6: Zonk Corp.

The following data pertains to

Q7: Zonk Corp.

The following data pertains to

Q8: Equity valuation models based on dividends,cash flows,and

Q10: Under the cash-flow-based valuation approach,free cash flows

Q11: Investors typically accept a lower risk-adjusted rate

Q12: Zonk Corp.

The following data pertains to

Q13: Firm-specific factors that increase the firm's nondiversifiable

Q14: The historical discount rate of the firm

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents