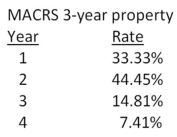

Peterborough Trucking just purchased some fixed assets that are classified as 3-year property for MACRS.The assets cost $10,600.What is the amount of the depreciation expense in year 3?

A) $537.52

B) $1,347.17

C) $1,569.86

D) $1,929.11

E) $2,177.56

Correct Answer:

Verified

Q59: Mason Farms purchased a building for $689,000

Q60: Nelson Mfg.owns a manufacturing facility that is

Q61: Champion Bakers uses specialized ovens to bake

Q62: Colors and More is considering replacing the

Q63: Kwik 'n Hot Dogs is considering the

Q65: Bernie's Beverages purchased some fixed assets classified

Q66: Edward's Manufactured Homes purchased some machinery 2

Q67: A project will produce an operating cash

Q68: Bruno's Lunch Counter is expanding and expects

Q69: A proposed expansion project is expected to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents