Johnson Corp.sponsors a defined benefit plan for its employee group.

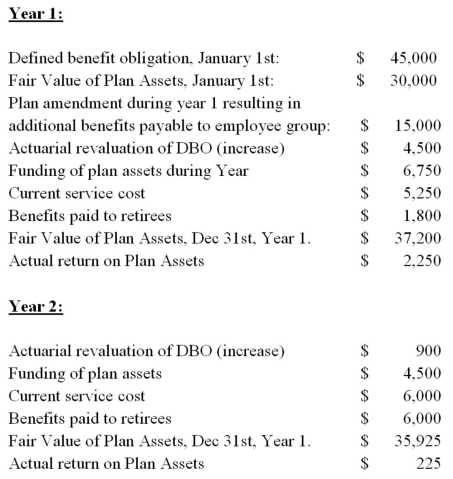

The following data pertains to the plan's first 2 years in existence:  Additional information:

Additional information:

- The plan was started on January 1st,Year 1,with $30,000 of funding.

- The company has a December 31st,year-end.

- The plan is non-contributory.

- The company's long-term debt is subject to a 6% discount rate.

What would be the pension expense for each of Years 1 and 2 under ASPE?

To go from pension expense under IFRS to ASPE,we need simply take the OCI amounts from IFRS and add them to the IFRS pension expense amounts to get the pension expense under ASPE:

Correct Answer:

Verified

Q79: The accrued obligation at the beginning of

Q80: Jamieson Corp.sponsors a defined benefit plan for

Q81: Jamieson Corp.sponsors a defined benefit plan for

Q82: When should the cost of termination benefits

Q83: What are plan settlements and curtailments and

Q85: Jamieson Corp.sponsors a defined benefit plan for

Q86: Johnson Corp.sponsors a defined benefit plan for

Q87: Jamieson Corp.sponsors a defined benefit plan for

Q87: What is the most critical value or

Q88: Jamieson Corp.sponsors a defined benefit plan for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents