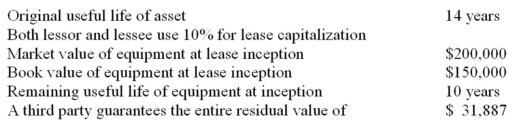

A company became a lessee by leasing equipment on January 1,2014 from a lessor.The lease has the following characteristics:  Six end-of-year lease payments are due beginning

Six end-of-year lease payments are due beginning  The lease term ends December 31,2019 Assume this is a finance lease for both parties.What is the present value of minimum lease payments for the lessee?

The lease term ends December 31,2019 Assume this is a finance lease for both parties.What is the present value of minimum lease payments for the lessee?

A) $200,000

B) $181,998

C) $180,000

D) $194,566

E) $178,233

Correct Answer:

Verified

Q60: The appropriate valuation of an operating lease

Q61: The lessee measures the cost of a

Q62: A 5-year lease contract is signed on

Q64: Lessee ABC INC.leased from Lessor QRS a

Q65: What are the three types of period

Q66: On January 1,2014,MU Corporation leased an asset,under

Q67: Which of the following would be excluded

Q68: At the inception of a finance lease

Q127: Finance revenue is recognized on a finance

Q162: The treatment of gains and losses under

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents