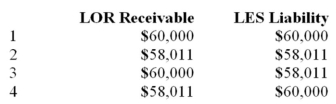

On January 1,2014,LOR leased a machine (original cost $60,000) to LES for a 5-year period at an implicit interest rate of 15 percent.The lease qualified as a direct financing lease and the annual lease payments ($17,306) are made each December 31.LOR retained the $4,000 estimated unguaranteed residual value ,LOR's net receivable and LES's liability would be (round to the nearest dollar) :

A) Choice 1

B) Choice 2

C) Choice 3

D) Choice 4

Correct Answer:

Verified

Q174: LMO leased an asset for use in

Q176: On January 1,2014,LE Corporation leased a machine

Q177: On January1st,2014,ABC Inc.(the lessor)agrees to lease a

Q178: The inception of a lease is 1/1/x1.A

Q179: RST entered into a direct financing lease

Q180: On January1st,2014,ABC Inc.(the lessor)agrees to lease a

Q188: Ryan Corp.enters into and sale and leaseback

Q209: What guidelines are used under IFRS to

Q213: Lessor Company rented a machine to Lessee

Q227: Ryan Corp.enters into and sale and leaseback

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents