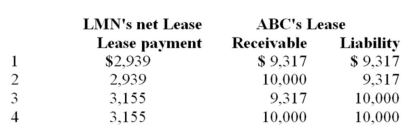

On December 10,2014,LMN purchased a special machine for leasing purposes; it cost $10,000.On January 1,2015,the machine was leased to ABC INC.under the following terms (it is a direct financing lease) : a.lease term 4 years; interest rate 10 percent; rentals payable at year-end.b.LMN retains the residual value of $1,000 .There is no guarantee on the residual value. On January 1,2015,when the lease term starts,the following accounting amounts should be used:

A) Choice 1

B) Choice 2

C) Choice 3

D) Choice 4

Correct Answer:

Verified

Q163: On January1st,2014,ABC Inc.(the lessor)agrees to lease a

Q166: On January1st,2014,ABC Inc.(the lessor)agrees to lease a

Q167: On January1st,2014,ABC Inc.(the lessor)agrees to lease a

Q169: WXZ entered into a direct financing lease

Q187: Leasing assets can result in much time

Q188: Ryan Corp.enters into and sale and leaseback

Q209: What guidelines are used under IFRS to

Q213: Lessor Company rented a machine to Lessee

Q221: A lessee rented a machine that had

Q227: Ryan Corp.enters into and sale and leaseback

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents