LAC has negotiated a lease agreement with LEC effective January 1,2014.LAC will provide LEC with a special-purpose building for ten (10)years.The lease is non-cancellable; requires LEC to provide maintenance,insurance,taxes,etc.; and stipulates that the building reverts back to LAC's control at the end of the lease.The building cost LAC $200,000 and is expected to have no residual value at the end of the lease.LAC expects a 15% return on investments and the lease qualifies as a direct financing lease.Rents are paid each December 31 starting in 2014.

(a)How much annual rent will the lessee pay (rounded to the nearest dollar)? $______________________________.

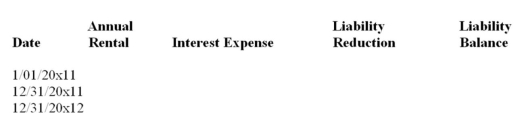

(b)Complete the following schedule of lease amortization for the lessee for the first two years:

(c)Complete the following entries for the lessee: January 1,2014,inception of lease.

December 31,2014,first rental payment and lessee's year-end entries (end of the accounting period).

December 31,2014,accrual by lessee of $4,000 taxes on the building and payment of $800 for repairs on the building.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q183: Ryan Corp.leased an asset from Amanda Corp.under

Q192: You are analyzing the balance sheet of

Q193: On January 1,2014,LOR Company rented a machine

Q194: Company A enters into a lease agreement

Q194: On January 1, 2014, TA acquired a

Q195: Ryan Corp.enters into a finance lease agreement

Q201: Ryan Corp.enters into an agreement with Montgomery

Q202: What is the interest rate used for

Q203: Ryan Corp.leased an asset from Amanda Corp.under

Q225: Explain what a temporary difference is and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents