Lamont Company leases computers for a three-year term,at the end of which they are regarded as obsolete with no residual value because Lamont donates them to schools.Rents are collected at the end of each six-month period; the leases qualify as direct financing leases to Lamont (lessor).The computers cost Lamont $20,000 each.Lamont bases the rents on a 16% annual rate.

(a)The semi-annual rental on one computer,rounded to the nearest dollar,is $________________________.

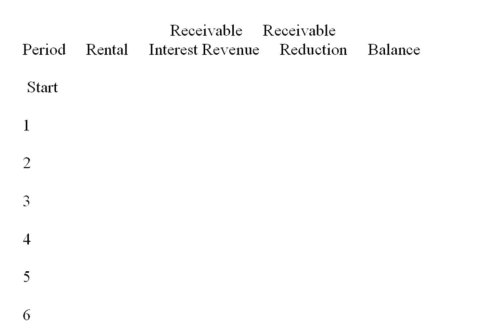

(b)Complete the following amortization schedule for the lease of one computer.

(c)Give the entries that should be made by the lessor on the following dates:

(1)At the date the lease is signed:

(2)At the date of collection of the first rental payment:

(d)Show the lessor's income statement and balance sheet amounts with respect to the lease immediately after the first rental collection:

Correct Answer:

Verified

...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q190: On January 1, 2014, a lessor and

Q191: What is a sales-type lease?

Q206: If lessor has property that has a

Q207: The following information relates to a lease

Q212: The following information relates to a lease

Q214: What are the income tax implications for

Q220: List the guidelines required under ASPE that

Q224: Lessor Company rented a machine to Lessee

Q228: LOR leased to LEE a computer that

Q233: LXR leased to LXE a computer that

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents