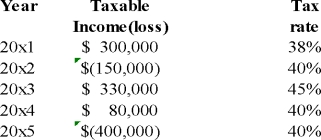

JR Ltd.provided you with the following information:  There are no temporary differences.What will be the amount of the tax refund received in 2015 assuming that a policy of tax refund maximization is followed?

There are no temporary differences.What will be the amount of the tax refund received in 2015 assuming that a policy of tax refund maximization is followed?

A) $32,000

B) $172,550

C) $176,500

D) $80,000

Correct Answer:

Verified

Q71: MDB had a $1,200 temporary tax difference

Q72: JR Company incurred a loss in 2011,due

Q73: All of the following are true regarding

Q74: VB Ltd.provided you with the following information:

Q77: XYZ Inc.is a publicly traded company.At the

Q78: What factor would most likely cause a

Q79: The maximum number of years a tax

Q80: XYZ Ltd.,a taxable Canadian corporation,reported the following

Q91: How does the existence of a loss

Q98: There is some question as to whether

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents