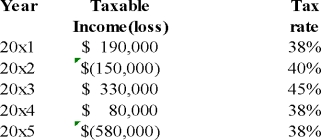

VB Ltd.provided you with the following information:  There are no temporary differences.The deferred income tax benefit of the loss carry forward was set up in 2015 as the probability of realization was greater than 50%.In 2016 it was determined that the probability of realization was less than 50%.What would be the carrying amount of the deferred income tax benefit-loss carry forward on the balance sheet at the end of 2016?

There are no temporary differences.The deferred income tax benefit of the loss carry forward was set up in 2015 as the probability of realization was greater than 50%.In 2016 it was determined that the probability of realization was less than 50%.What would be the carrying amount of the deferred income tax benefit-loss carry forward on the balance sheet at the end of 2016?

A) $194,100

B) $0

C) $220,000

D) $64,600

Correct Answer:

Verified

Q64: CJM provided the following data related to

Q65: Reducing CCA is one tax strategy that

Q66: FGH had a $1,200 temporary difference for

Q67: JR Ltd.provided you with the following information:

Q68: In 2013,JMR Corp.set up a deferred income

Q70: Reducing CCA is one tax strategy that

Q71: MDB had a $1,200 temporary tax difference

Q72: JR Company incurred a loss in 2011,due

Q73: All of the following are true regarding

Q74: VB Ltd.provided you with the following information:

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents