On January 1st,20x9,GHI Inc.granted options to its twenty employees allowing for the purchase of 12,000 shares at $5 per share.The options vest evenly over the 3 years following the date of issue.The options are only exercisable as of December 31st,20x11.The fair value of these options (using an Option Pricing model)is $30,000.

Part A: Assume that all options have vested but that none were exercised on December 31st,20x11.Provide the required journal entry.

Part B: Assume that all options have vested and all were exercised on December 31st,20x11.Provide the required journal entry.

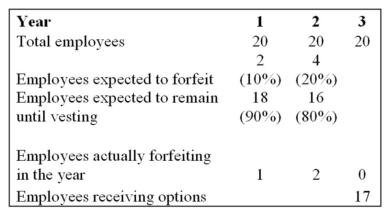

Part C: Suppose that some of the options were forfeited by the employees.Actual and estimated forfeiture data are provided in the table below:  Provide the required journal entries to record the accrual of compensation expense and the exercise of the options as per IFRS.

Provide the required journal entries to record the accrual of compensation expense and the exercise of the options as per IFRS.

Part D: Suppose that some of the options were forfeited by the employees.Actual and estimated forfeiture data are provided in the table below:

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q110: JMR Ltd.issues a $150,000, 7%, five-year debenture

Q117: JMR Corp.grants their top executive an option

Q118: On January 1,2014,ABC Incorporated issued $10,000,000 face

Q119: On January 20X2, ABC Corporation issued $1,000,000

Q121: On January 1st,20x1,20,000 units of stock appreciation

Q123: On January 1,2014,ABC Incorporated issued $10,000,000 face

Q124: On January 1,2014,ABC Incorporated issued $10,000,000 face

Q125: Assume that on January 1st,20x1,Jane Smith is

Q126: On January 1st,20x12,ABC Inc.agrees to a futures

Q127: On January 1,2014,ABC Incorporated issued $10,000,000 face

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents