Capital budgeting analysis is very important,because it

A) involves, usually expensive, investments in capital assets.

B) has to do with the productive capacity of a firm.

C) will determine how competitive and profitable a firm will be.

D) all of the above

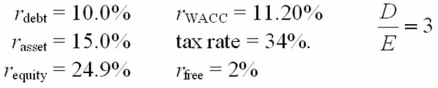

Tiger Towers, Inc.is considering an expansion of their existing business, student apartments.The new project will be built on some vacant land that the firm has just contracted to buy.The land cost $1,000,000 and the payment is due today.Construction of a 20-unit office building will cost $3 million; this expense will be depreciated straight-line over 30 years to zero salvage value; the pretax value of the land and building in year 30 will be $18,000,000.The $3,000,000 construction cost is to be paid today.The project will not change the risk level of the firm.The firm will lease 20 offices suites at $20,000 per suite per year; payment is due at the start of the year; occupancy will begin in one year.Variable cost is $3,500 per suite.Fixed costs, excluding depreciation, are $75,000 per year.The project will require a $10,000 investment in net working capital.

Correct Answer:

Verified

Q4: The financial manager's responsibility involves

A)increasing the per

Q8: What is the levered after-tax incremental cash

Q11: What is the NPV of the project

Q14: What is the unlevered after-tax incremental cash

Q14: What is the levered after-tax incremental cash

Q15: Today is January 1, 2009. The state

Q16: What is the levered after-tax incremental cash

Q18: What is the unlevered after-tax incremental cash

Q19: What is the NPV of the project

Q20: When using the APV methodology, what is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents