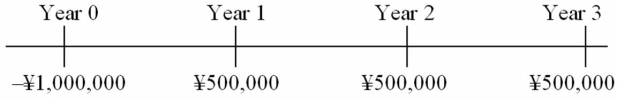

The spot exchange rate is ¥125 = $1.The U.S.discount rate is 10%; inflation over the next three years is 3% per year in the U.S.and 2% per year in Japan.Calculate the dollar NPV of this project.  I did not round my intermediate steps,if you did,select the answer closest to yours.

I did not round my intermediate steps,if you did,select the answer closest to yours.

A) $267,181.87

B) $14,176.67

C) $2,536.49

D) $2,137.46

E) None of the above

Correct Answer:

Verified

Q48: The adjusted present value (APV) model that

Q49: As of today, the spot exchange rate

Q52: Sensitivity analysis in the calculation of the

Q52: An Italian firm is considering selling its

Q53: As of today, the spot exchange rate

Q56: Assume that XYZ Corporation is a leveraged

Q59: The "incremental" cash flows of a capital

Q68: Find the dollar cash flows to compute

Q70: What is the dollar-denominated IRR of this

Q73: What is CF5 in dollars?

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents